Grand Plans: November 9, 2023

A semi-monthly newsletter from Grand Plans designed to normalize and celebrate our glorious geri-destiny through information, stories, real talk conversation, smart planning and shared experience.

Geri-news you can use

You know you’re getting older when…retail news like this doesn’t compute.

One of the 20 steps to mitigating geri-drama is to embrace and celebrate all the cool new roles that come our way as we age — especially being a Grandparent! Here’s how to be a more connected one…

…or a more complimentary one. This applies to everyone you meet on your senior stroll, highly important IMHO!

It’s important because people on our journey need to hear it — deeply.

If you’re looking for inspiration on how to be a loving, better connected, compliment-giving and tummy-warming grandmother, look no further than this Tik-Tok icon.

Geris-prudence

If you’ve ever wondered what Medicaid asset protection trusts are and why you might need to include them in your Grand Planning, then this article in Very Well Health is for you. After reading, consider learning more about what elder law attorneys do and how you can find one in your community.

“Medicaid Asset Protection Trusts (MAPTs) are irrevocable trusts that protect a Medicaid applicant’s assets from being counted for eligibility purposes. MAPTs enable people who would otherwise be ineligible for Medicaid to become eligible and receive the care they require at home or in a nursing home.

It's important to be aware of the Medicaid look-back period: The government looks to see if you have any assets that were gifted, transferred, given away, or sold for less than their fair market value over a specific timeframe (determined by each state).

Benefits of creating a MAPT include protecting assets while still qualifying for Medicaid and the assets in the MAPT are not included in the estate for the calculation of Medicaid recovery, estate tax, or probate. Some of the cons of a MAPT include not being the trustee; the advanced timing required to create a MAPT; and potential effects on quality and choice of care.”

Fit as a fiddle

According to March 2023 data from the U.S. Centers for Disease Control and Prevention (CDC) and other research, more than one out of four Americans age 65+ falls each year, making falling the leading cause of fatal and nonfatal injuries among older adults. Fall prevention is a huge concern for the aging population. “Unfortunately, this can lead to a cycle of balance deterioration, as that person becomes more sedentary during recovery or chooses to be more sedentary out of fear of another fall,” says ACE-certified personal trainer and group fitness instructor, Amy Gunther. “This is an example of long-term loss of balance. Occasionally, balance loss can be short-term. Some medications cause dizziness, as do some illnesses like ear infections. Any loss of balance from those situations can be regained quickly with practice. Here are some examples of balance exercises you can do at home, and you can use a chair to help balance yourself: calf raises, standing on one leg for 20-30 seconds (like a flamingo), standing side leg raises and walking.”

The grand sum

Learn about some money-saving benefits for retirement and your Golden Years, you know, that season of life we should all be planning for now, but by and large aren’t. “For some people, retirement conjures up notions of leisurely mornings, golf outings, and bucket-list vacations. But for older adults who don't have enough retirement savings, the picture isn't quite as rosy. A recent survey by Clever found that 40% of older adults regret they didn't save more for their later years, and 56% of retirees wish they'd retired later,” the National Council on Aging article reads.

In other news, should retirees pay off all their debt?

Podcast News: Grand Plans Season 2

Next up in the Season 2 lineup is an interview with Heather Hausenblas, PhD, an award-winning health researcher in Jacksonville, FL who publishes the Wellness Discovery newsletter and by so doing keeps us all well informed about making healthy choices! This interview was one of my favorites — don’t miss it. Find it here, or wherever you get your podcasts on the line.

Things I’m prattling on about today

Let’s play “The What-If Game” like our life depends on it, because it’s a much better game than the alternatives, “What Now?” or, “What Did You THINK Was Going to Happen?” which are both terrible games that require zero strategy and yield no winners whatsoever.

In “What-If” you are in pole position when you can answer or at least consider questions like “What if I become incapacitated but am otherwise healthy and lucid for decades, how will I cover my care costs and where would I live?” Or, “What if I develop dementia, how can I mitigate its impact on myself and others and how much will that cost?” Or, “What if I am no longer mobile, how will I maintain my independence and what tools, resources and savings will I need to keep chugging along in my own special way?”

So many rabbit holes, so many hard questions — but so much panic averted for all when you at least play the game and start the conversation and strategy-building. #GrandPlans

Shelf Life

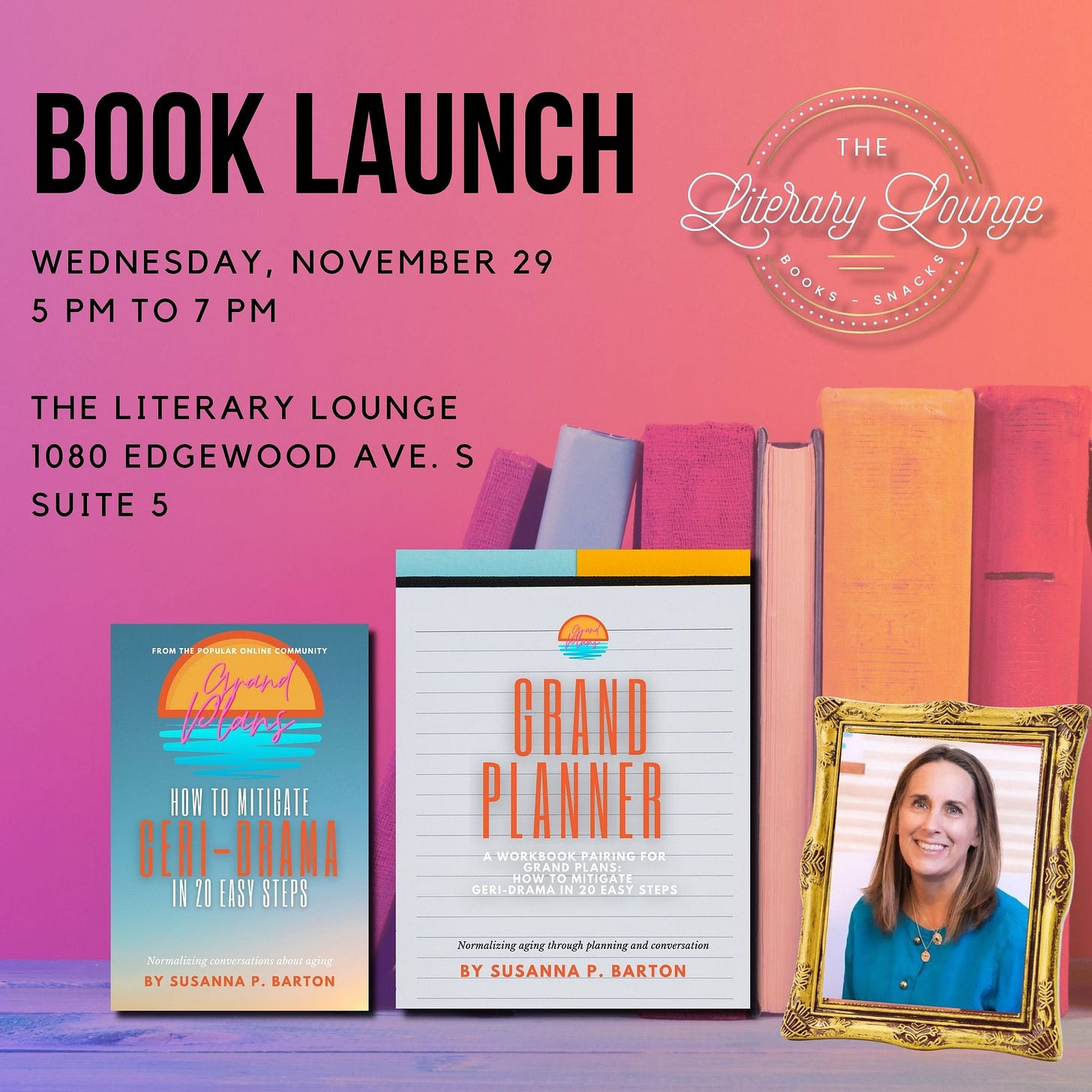

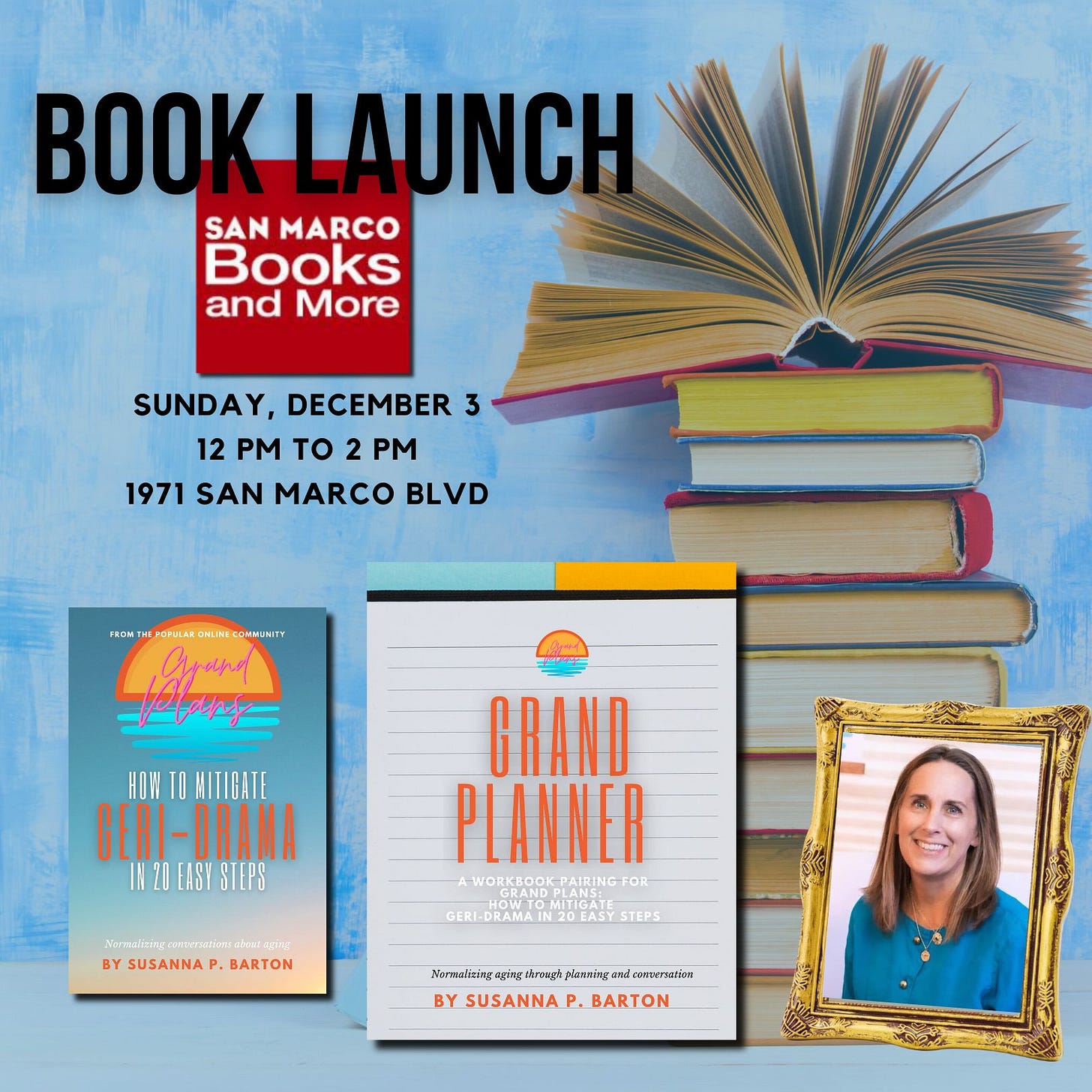

I’m thrilled to announce my labor of love books, Grand Plans: How to Mitigate Geri-Drama in 20 Easy Steps and Grand Planner, are available now for purchase. If you’re in Jacksonville, FL, I invite you to buy your copies locally at one of our upcoming book launch events at the Literary Lounge in Murray Hill and the San Marco Bookstore:

A February launch is in the works at The Twig bookstore, another great place to keep your dollars local in San Antonio, TX!

If buying locally isn’t an option, visit www.mygrandplans.com for links to purchase on Amazon. Thanks for your support!

Shared experience

We can all learn from each other’s geri-scary moments. What are some of your takeaway lessons? What have you promised yourself you’ll never do to your loved ones? What worked for you? What didn’t? More conversation and story-sharing helps elevate the geri-experience for all of us. If you are willing to share your grand tales, email susannabarton@me.com and I’ll put them in an upcoming newsletter. Here’s today’s Shared Experience:

“We have already transferred our assets into a revocable trust. That way there won’t be probate or estate tax issues for either one of us or our kiddo. Again, we are fortunate their lawyer was able to do the same for my parents’ assets, which are considerable. My mom would have been in a world of hurt had my father passed before we knew the ramifications of not moving them. Especially in Florida.”

— Anonymous

O-Bitchin

Many of us may remember the recent news about Chicago-area senior living resident Dorothy Hoffner, who skydived this fall at age 104 then died a few days later. Talk about legacy! I wondered what her obituary would be like, and here it is in all of its beautiful simplicity and wonder:

“Dorothy June Hoffner, just months short of her 105th birthday, died peacefully on Monday, October 9, 2023 at her home at Brookdale Senior Living, in Chicago where she lived independently. Just one week before her death Dorothy completed her second sky dive, a feat which has been submitted for certification to the Guinness Book of World Records as oldest person in the world to tandem sky dive.” (Read the rest of Dorothy’s obituary here.)

Some golden gedunk and goods

I’ve been keeping my workouts on the DL at home, where no one can see me swinging my kettlebell around in a big ole white nightgown. You can scour Tik-Tok for all sorts of great kettlebell exercises demonstrated by fit influencers in real work out clothes.

One thing I did score from Dad’s Holly Springs home purge was a pair of hand weights he apparently was using on the regular. They turned out to be a great fitness resource, and in this case, add a little sentimentality to my home workout scene.

If you’re looking for kicks, these mofos do the trick for me, though I know all the cool kids are into Hokas because they’re stylish and functional.

Check out our Grand Plans merch in our new Etsy storefront.