Grand Plans: May 9, 2024

A semi-monthly newsletter from Grand Plans designed to normalize and celebrate our glorious geri-destiny through information, stories, real talk conversation, smart planning and shared experience.

Things I’m prattling on about today

My last post about all signs pointing to a scant senior future was unapologetically foreboding, but never fear — I am back with a plan to mitigate any hand-wringing it may have inspired. In communication and marketing land, it’s known as a “call to action,” or CTA, so let’s jump right into that before we bust a collective rod over how we will navigate the crowded, increasingly older and decidedly underfunded and overstretched Golden Years experience waiting for us on the horizon — shall we?

Basically, the CTA for designing our very best, most Grandest-planned second half is to run with one of the following three actionable items:

1) Develop a business plan for a service or company that can provide much-needed resources for this demographic and make lots and lots of money!

Kidding, not kidding. If I was good at Algebra II and wasn’t so introverted and risk-averse, I would be figuring out a way to capitalize on the many shortfalls in senior services, amenities and resources and improve the outcomes for everyone, while lining my pocketbook lol. I would get into senior housing development and assisted living facility construction and age-in-place home construction services and retirement community planning. I’d buy into medical companies that provide geriatric care services and caregiving placement firms and figure out how to attract and retain and endless well of higher-paid, better trained caregivers. I’d start or invest in professional firms that provide geriatric care management, daily money management and care scheduling services, like my heroic and hardworking friend Heather Bayfield, who founded Life Management Advisors and Care Management Advisors many moons ago (because she saw the signs!) and has been tremendously successful in her work. I might consider selling long term care insurance. I would invest in inventive companies that deliver seniors-specific goods, foods and products and if nothing else, I would offer my own driving services and make BANK driving older adults around town, at least until I myself needed to become a passenger. The business opportunities to meet the demands of this wonderful, smart, HUGE and growing market are really endless.

2) Dream up a charitable or nonprofit organization that can provide much-needed resources for this demographic and make a difference!

Seeing the needs, trends and deficits and throwing your heart at it all by establishing a charitable venture also can fulfill the mission. There are so many great examples of this happening around the country. In Jacksonville, Joanne Hickox founded the nonprofit Seniors on a Mission because she saw a need for more seniors to have purpose and share their volunteer strengths. That evolved into an outreach of mobile technology instruction and other service work. And that eventually developed into an even more concrete way to serve the market: to provide low cost housing in a community, working farm environment for seniors to live, serve and find purpose in a concept called the G3 Village. Those plans are gaining momentum and one day soon, will be helping to fill the gap of senior housing in Northeast Florida. ElderSource is another great example. Its nonprofit mission is to “empower people to live and age with independence and dignity in their homes and community.” Its main responsibilities are to: identify the needs of elders and caregivers in our service area; develop plans to meet these growing needs of our aging population; contract with local agencies to deliver services to clients who need help; and provide oversight of the contracts, ensuring good stewardship of funds and quality services.

3) Study the numbers and signs and trends, talk about it all with your people and alter your own Grand Plans accordingly.

This is the easiest and most attainable CTA of the three, and all it takes is an investment of your time and an acceptance of the possibilities. Also, it requires your flexibility with outcomes and a willingness to change it all up if you must. Most of all, this option requires an open mind and a readiness to understand the options. While you may not reap the same paybacks or credit as you would starting a new for-profit or nonprofit business, the rewards are priceless when it comes to being realistic, communicative and well educated about your Grand Planning work and sharing it openly with your loved ones, friends and community. This is a plan in which we can all invest and find success!

News you can use

Time to start saving and being pennywise, it seems. Here are some benefits that help pay for food, some tips to reduce your monthly expenses and where to find help with your budget, all from the National Council on Aging.

Or you can invest in making memories with your grands! Here are some great ways to find “volun-tourism” travel opportunities.

Just don’t pack any lace undergarments, because they’re banned in some countries. If that leaves you “bummed,” read up on the dangers they can inflict on your nether regions.

Whatever you do, make sure you’re healthy and taking the proper precautions for things like Bird Flu.

And don’t forget to be knowledgeable about the bright young female athletes inspiring greatness in your girl-grands.

Grand Plans Podcast

Season 3 of the Grand Plans podcast is a wrap, and you can find all the great episodes from the season wherever you download your podcasts. Here’s a link to Season 3 Episode 6.

Geris-prudence

As an executor, when you need to call an attorney, from San Antonio-based attorney Seth K. Bell:

Advanced health and wellness

From the National Institute on Aging:

The grand sum

From Sixty & Me:

“Many of you might have purchased life insurance at some point because someone depended on you financially and you are a responsible person. But what if you were sold a permanent policy that you don’t need anymore, if you ever needed it. There are different types of permanent insurance, but this article focuses on whole-life insurance.” Read more here.

Shelf life

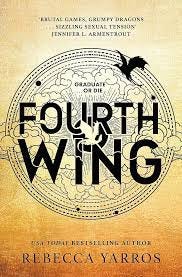

Fourth Wing is not a book on aging, but it will definitely keep you young at heart and feel a little spicy! Totally not a fantasy reader, I explored this genre for the first time since I read A Wrinkle in Time and consumed it in all of two days. Yes, it’s about dragons and girl warriors, but all the great reviews can’t be wrong and I certainly concur it’s a must-read!

Shared experience

We can all learn from each other’s geri-scary moments. What are some of your takeaway lessons? What have you promised yourself you’ll never do to your loved ones? What worked for you? What didn’t? More conversation and story-sharing helps elevate the senior experience for all of us. If you want to share your grand tales, email susannabarton@me.com and I’ll put them in an upcoming newsletter.

O-bitchin’

Martha Dougharty Sparks, August 20, 1942 — April 2, 2023

Martha Dougharty Sparks, 80, of Beaumont, Texas, finally ceased badgering her alleged sons on what they should do with their lives on April 2, 2023. To make sure things were complicated, she died in Houston, Texas at the MD Anderson Cancer Center, forcing her two sons to pay for her to have an understandably awkward Uber ride back to her home in Beaumont. But Martha didn’t go without a fight—nor without full make-up and bright-red lipstick.

A final gathering for creditors to meet our friends and confirm we don’t have any money left will be held from 5:00 p.m. to 7:00 p.m., Monday, April 10, 2023, at Claybar Kelley - Watkins Funeral Home in Beaumont. Read more here.

Some golden gedunk and goods

Get yourself another few copies of Grand Plans: How to Mitigate Geri-Drama in 20 Easy Steps and the Grand Planner for all the people who like getting gifts in your life! Visit www.mygrandplans.com for links to purchase on Amazon.

And

Check out our Grand Plans merch in our Etsy storefront.